0%

Time Saved

0+

Investors | Startups

0+

Matchings

0%

Focus

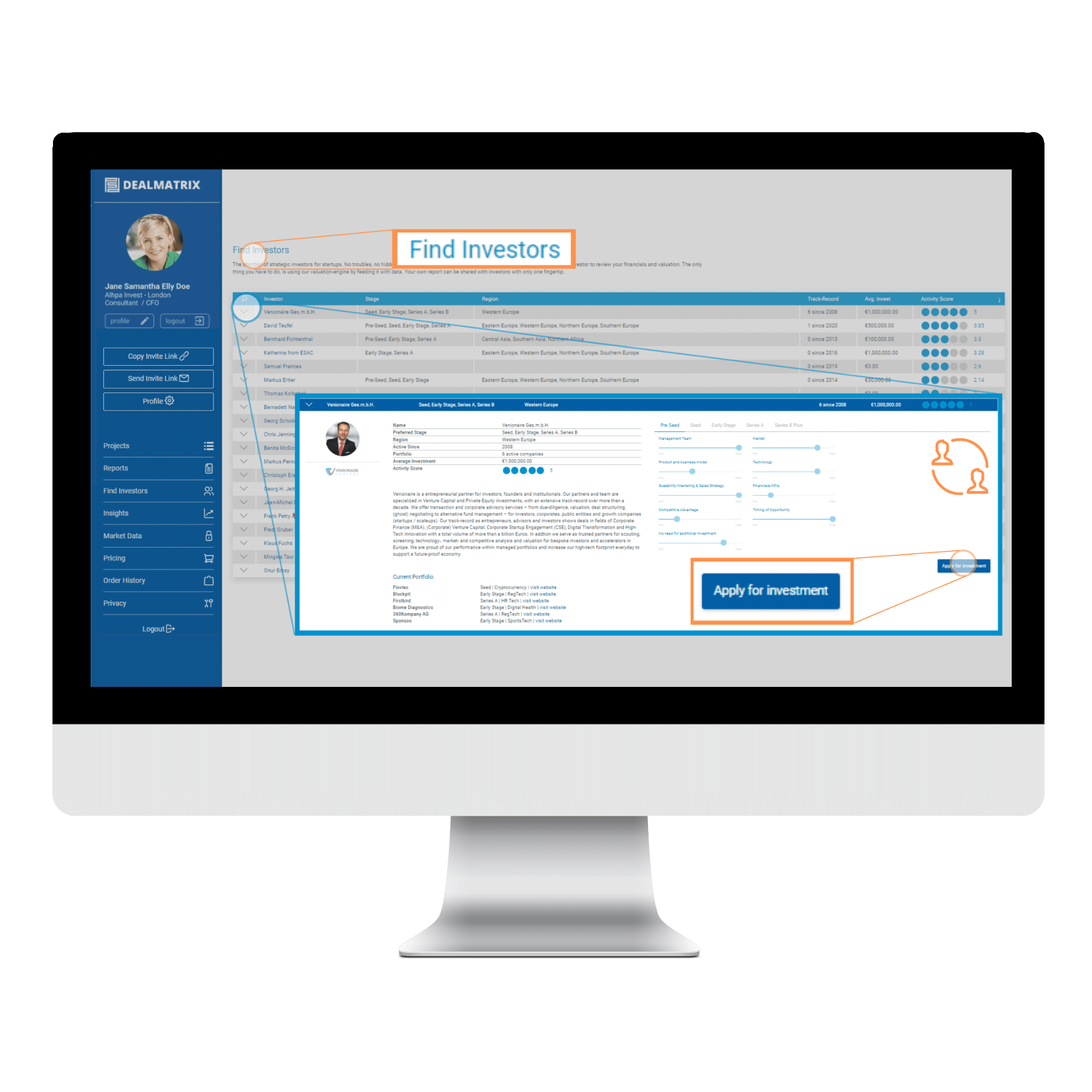

Focus on deal making

Reliable Market Data

Solid market data from third parties is key for valuations. We map external data with anonymous data points from our system through our algorithms to discover averages and trends for you.

Run calculator based on solid assumptions

AI-driven guidance based on your profile*

*Available in future product updates